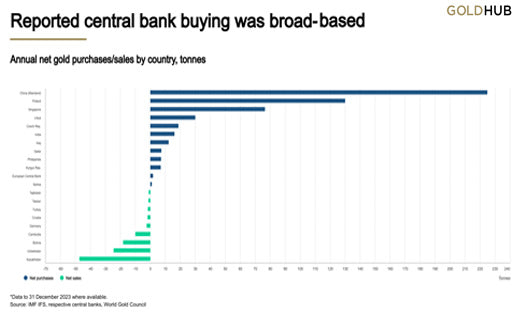

China’s central bank, the People’s Bank of China, has been generating headlines for its large gold purchases. But other central banks are also aggressively accumulating gold. In fact, during the first quarter of 2024, the Central Bank of Turkey bought more gold than China. Turkey purchased 30 metric tons, while China added 27 tons, according to the latest data from the World Gold Council.

After having purchased gold for ten consecutive months, Turkey now has holdings of 570 tons, placing the country 12th in the world in gold reserves. China now holds 2,262 tons of gold, up 16 percent from the end of October 2022, when it began its year-and-a-half-long streak of gold buying. China’s government gold holdings rank seventh in the world, behind the United States, Germany, the International Monetary Fund, Italy, France, and Russia.

Other major sovereign buyers during the first quarter included India, at 18.5 tons, and Kazakhstan, which accumulated 16 tons. The Czech Republic and Oman both purchased more than 4 tons of gold. Singapore, the Kyrgyz Republic, Qatar, and Poland also added to gold reserves during the quarter.

A metric ton, the universal measurement for gold reserves, is equivalent to 1,000 kilograms or 2,204 pounds, about ten percent heavier than a U.S. ton, which is 2,000 pounds.

During the first quarter, governments accumulated gold at the fastest quarterly pace on record, according to the World Gold Council which predicts central banks will maintain their voracious appetite for the precious metal this year, “providing a key pillar of support for gold.”

Real Time Precious Metals Data Below