Traditionally, Asian gold investors are very price sensitive, tending to take profits when the price of gold jumps, then waiting for pullbacks to buy. Western investors, in the U.S. and Europe, historically have bought into rallies, eager to benefit from a bullish market. But the World Gold Council reports that these approaches were reversed during the first quarter of 2024. Asian and Middle Eastern investors were buying aggressively into gold’s record-breaking rally. At the same time, many investors in the U.S. and Europe were taking profits as the gold price kept setting new records, even as demand for bars and coins remained healthy.

The net result for the first quarter was that global gold bar and coin investment increased 3 percent year-over-year to 312 metric tons. Demand was strong for small gold bars, while there was a drop in demand for gold coins.

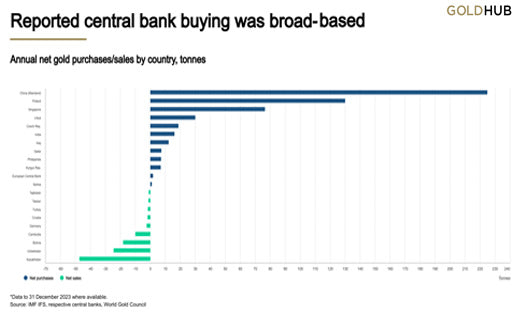

China led investor demand for gold bars and coins, with purchases of 110 tons, up 68 percent from the year-ago quarter. It was the biggest quarter for gold buying in China in more than seven years. Chinese investors are prioritizing capital preservation, given sharp declines in local property and stock markets. Continued aggressive purchases by China’s central bank are adding to gold’s allure in Asia.

Bar and coin investment in India, the second largest market for gold, increased 19 percent from the year-ago period to 41 tons.

The United States saw net demand of 18 tons, reflecting heavy profit taking, while gold bar and coin demand in Europe also totaled 18 tons during the quarter.Real Time Precious Metals Data Below