It can be hard to predict how silver prices will react, especially in an uncertain economy. Like any other commodity, the price of silver goes up and down in response to market forces like speculation, supply, and demand. So while it’s impossible to predict the price of silver with 100% accuracy, we can learn a lot about silver prices by studying trends in the market.

In this article, we’ll explore the price trends of silver over time. Then we’ll examine the current market trends that are affecting silver prices. With a solid understanding of historical trends in silver prices, you can make more informed decisions about when to buy silver.

SILVER’S HISTORY

Silver’s scarcity means it’s been a valuable asset for thousands of years, and silver prices have historically reflected its intrinsic value. Over the past century, the price of silver has swung from Depression-era lows of 25 cents per troy ounce to an all-time peak of almost $50 per troy ounce in 1980. Following this peak, the price of silver remained relatively low (under $10/ounce) until the Great Recession of 2008-9, when the price began a two-year climb to near-peak levels.

Over the past several years, silver has hovered around $21 per troy ounce.

WHAT IS SILVER USED FOR?

Silver has many industrial and commercial uses. These applications drive demand, which in turn affects the price of silver. Here are a few of the most common uses of silver:

- Jewelry and silverware

- Consumer electronics

- Semiconductors

- Nuclear reactors

- Batteries and solar panels

- Medicine and dentistry

DETERMINING SILVER’S CURRENT PRICE

The price of silver isn’t always linked directly with supply and demand or speculation. The performance of other markets has a knock-on effect on silver’s price. Factors such as the stock market, inflation rate, and the money supply influence the price of precious metals such as silver. The economies of the United States and China also affect silver prices more than other economies. There is currently some debate as to whether silver is an undervalued asset. Some economists believe that silver is currently undervalued, meaning that the market may soon correct and skyrocket in price. If that’s the case, now is the time to buy silver.

SILVER’S FUTURE

There are too many variables to determine exactly how the market will move, but as of the time of publication, silver prices are nowhere near historic highs—meaning that now might be a great time to acquire silver assets. Buying precious metals such as silver is a great hedge against inflation because of its intrinsic value. So even if the price drops, it will always bounce back. Of course, the same can’t be said for fiat currency. While silver tends to be more volatile than gold, its many industrial and commercial applications make it a relatively safe bet for those looking to diversify their holdings.

CONCLUSION

In uncertain times, buying assets such as precious metals is a smart move. So while it can be difficult to accurately predict trends in the silver market, silver occupies an important role in the world economy and always recovers from price drops. And time, of course, is your best friend!

If you’re interested in adding silver bullion or coins to your portfolio, Nationwide’s experts are standing by, ready to help you. Contact us today to start growing your safety net!

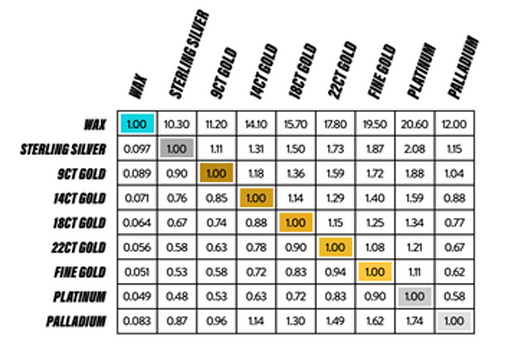

Real Time Precious Metals Data Below