More than 280 U.S. banks are suffering from excessive commercial real estate exposure and billions of dollars of unrealized losses on low-interest bonds whose values have plummeted, according to a new study.

Financial services advisory firm Klaros Group’s in-depth analysis of U.S. banks finds 282 banks, with nearly $900 billion in total assets, face potential instability due to loans on troubled commercial real estate and investment losses tied to interest rate increases.

Just one of the banks has more than $100 billion in assets—New York Community Bank, which recently received a $1 billion lifeline from private equity investors led by ex-Treasury Secretary Steven Mnuchin. Of the other banks facing financial stress, 16 have assets between $10 billion and $100 billion, and 265 are smaller banks with less than $10 billion in assets.

“If there were just 10 banks that were in trouble, they would have all been taken down and dealt with,” said Klaros co-founder and partner Brian Graham. “When you’ve got hundreds of banks facing these challenges, the regulators have to walk a bit of a tightrope.” The troubled banks will need to raise capital or merge with stronger financial institutions, according to Graham.

Federal regulators haven’t assessed the banking problem to be as serious as Klaros’ analysis. At the end of 2023, there were 52 banks on the Federal Deposit Insurance Corporation’s “Problem Bank List.”

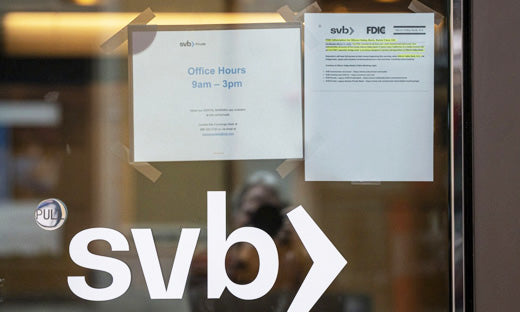

Five U.S. banks failed in 2023, three of them major banks that collapsed within days of each other—Silicon Valley Bank, First Republic Bank, and Signature Bank—due in part to heavy losses on low-interest bonds and overexposure to the volatile cryptocurrency business.

Real Time Precious Metals Data Below