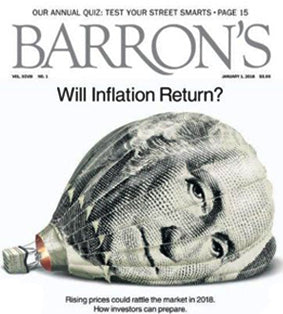

Barron’s, the high-profile magazine devoted exclusively to investments, recommended gold to its readers in a January article with dual titles: “Gold Could Glitter Anew in 2018, and Beyond” in print and, online, “Gold’s Recent Rally Could Be Just the Start.”

Barron’s argues, “this could be an opportune time to begin building or adding to a position in the metal.” Through mid-January, gold was up eight percent from its December low.

Two fundamental factors that drive the price of gold are currently in the precious metal’s favor, Barron’s maintains: a decline in the dollar and a rise in inflation. The greenback’s ten percent dip in 2017 helped drive gold higher last year, and Barron’s believes the dollar may continue falling, particularly if the economies of Europe and China pick up speed, and if their central banks raise interest rates. Barron’s sees inflation rising as the global economic expansion continues into 2018.

“Gold is looking strong, and not all of this rise is for the short term,” says John Hathaway, Chairman of Tocqueville Management and co-manager of the Tocqueville Gold Fund in the article, arguing gold is going “significantly higher over the next two to three years.”

Barron’s also predicts interest in bitcoin will benefit gold because “a major attraction of digital money is its freedom from government oversight,” as is true for gold. But, gold is far more stable than bitcoin and “can be held as bars and coins, a benefit if the electrical grid ever goes down.”

Real Time Precious Metals Data Below