As you build your retirement portfolio, you might be wondering, “Are gold IRAs safe?” A gold IRA has the same function as a traditional IRA; the only main difference is that the owner holds gold – or other precious metals – instead of stocks, bonds, and paper assets.

THE POLITICS OF GOLD IRAS

Since 2008’s financial crisis and the Great Recession that followed, the transformation of cash into precious metals with a gold IRA has been on the rise. Many people view precious metals as the purest form of currency. They can’t be devalued by banks or the government or manipulated by politicians and they don’t incur debts.

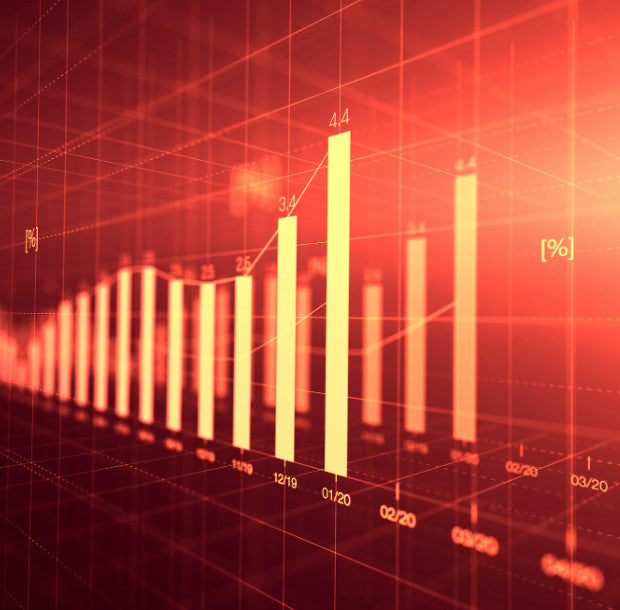

Certain political and economic conditions, including high gas and oil prices, stock market turmoil, a weakened U.S. dollar, and general political uncertainty, can cause stocks and paper assets to lose value. At the same time, these effects cause gold and precious metals to rise in value. (Ever wondered why gold is known as the “crisis commodity?” This is why!)

WHY GOLD IRAS ARE SAFE

The best reason to invest in gold is for the benefits that diversification provides. Gold is not correlated to the stock market, so it can’t suffer from huge unexpected falls in value. Gold prices typically move in a direction counter to paper assets, so including gold IRAs to one’s retirement portfolio is a safe way to even out the risk of inflation, particularly over the long term.

Two main things to look out for when considering if gold IRAs are safe:

- Don’t invest your entire retirement portfolio in a gold IRA. The key is to keep your portfolio diversified. If anyone recommends turning your entire nest egg into gold, be wary of their intentions.

- Don’t work with financial advisors if they recommend either a leveraged account (one in which the seller lets you borrow money to purchase precious metals) or if the seller requires exorbitant commissions for locating the precious metals for you. Work with an honest broker will who will help you find the bullion that is legitimately accepted for your gold IRA by the IRS, like our Gold American Eagles.

HOW TO OPEN GOLD IRAS

When it comes to gold IRAs, you have to work with a self-directed IRA custodian; a custodian is responsible for securing financial assets, similar to a bank but without any of the commercial functions. It’s important to work with a self-directed IRA custodian, because most traditional IRA custodians only work with traditional assets. This is the case whether you are opening one outright or interested in rolling your 401K over into a gold IRA.

Gold IRAs are available as traditional or Roth, but you must invest actual, tangible gold, whether coins or bullions. As mentioned above, the government currently allows our Gold American Eagles to be included in gold IRAs. Other acceptable precious metals include silver, platinum, and palladium, provided they are in an IRS-approved coin or bar product.

READY TO INVEST?

Gold has a long history as a store of value. Stocks and bonds can lose all value, but gold will never have a value of zero. All IRAs are subject to some risks, but traditional IRAs have their own set of risks that don’t apply to gold IRAs. Gold IRAs are safe for retirement, particularly with a nicely diversified portfolio! Are you ready to invest in a gold IRA for your retirement?

Real Time Precious Metals Data Below