On the border of Singapore’s Changi Airport is a massive six-story high warehouse that will house one of the world’s largest silver storage facilities with capacity for 15,000 tons. It is slated for completion next year, but a video posted to YouTube already displays silver being transported to the location that builder Silver Bullion Pte Ltd. is calling “The Reserve.” It is part of an industry bet that demand for physical ownership of silver is on the cusp of a multi-year boom.

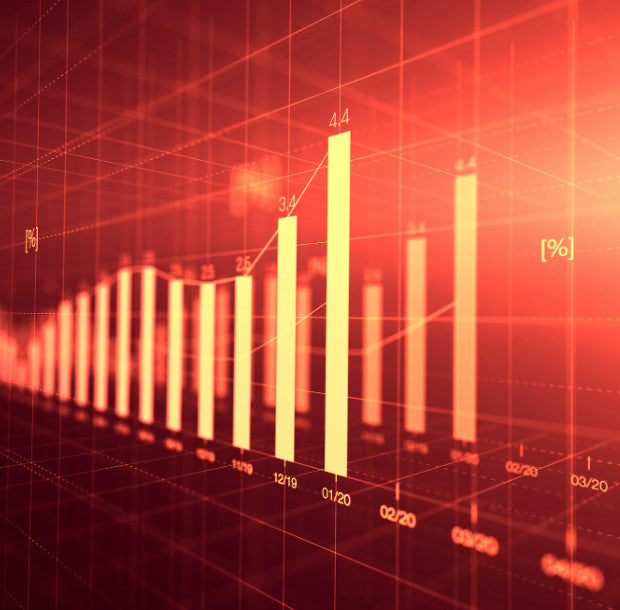

The price of silver soared on speculative buying in late January, fueled by chatter on the Reddit online forum, that culminated with a high above $30 an ounce on February 1. Since then, silver has returned to the mid-20s, but some analysts are anticipating a bounce back. Global bank Citigroup is predicting silver could peak at $30 an ounce in the second half of the year, boosted by robust investment demand.

The electronics, automotive, and solar panel industries all rely upon silver. As these businesses recover from coronavirus-induced slowdowns, industrial demand for silver will grow. Beyond a rebound in industrial demand, the Silver Institute forecasts investment demand for silver bar and bullion coins will rise this year to a six-year high of 257 million ounces.

To promote itself as a global center for precious metals, Singapore has declared individuals or businesses importing silver, gold or platinum into the country are exempt from paying goods and services tax.

Real Time Precious Metals Data Below