Without much fanfare, gold has quietly climbed to a new all-time high, reaching a new closing record of $2,184 an ounce in the New York futures market to end the first full week of March, after breaking $2,200 in intra-day trading.

Many analysts explain the rally by pointing to optimism that the Federal Reserve will cut short-term interest rates, which would reduce the opportunity cost of holding gold since gold, of course, offers no yield. But there’s much more at work driving the price of gold—what financial professionals call market internals.

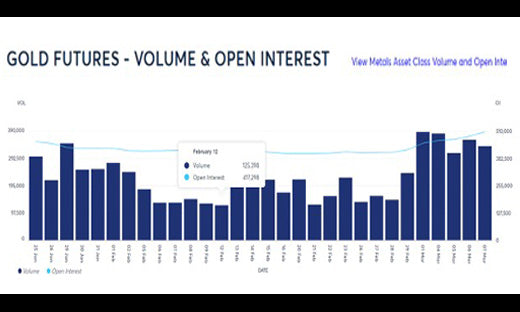

Since the final trading day of February, when gold jumped above $2,050, there has been a significant increase in both gold futures volume and open interest, which is the count of open contracts held by market participants, another way of saying gold is attracting a growing amount of attention.

On February 28, open interest for gold futures stood at just over 411,000 contracts. By March 7, that number had jumped to 507,000, an extraordinary 23 percent increase over the course of just six trading days. The combination of higher prices with rising volume and open interest implies investors are becoming increasingly bullish on gold.

In the backdrop, are the supportive conditions that have boosted gold for months: heightened geopolitical tension amid the wars in Ukraine and Israel; strong central bank purchases; and particularly aggressive buying in China. None of these factors shows any sign of letting up, meaning gold has a good chance of breaking through $2,200 an ounce.

Real Time Precious Metals Data Below