Yellow Gold Watches in Style for the Wealthy

Yellow gold is back in style for high-end luxury watches. New watch models from TAG Heuer, Vacheron Constantin, Hublot, and Cartier...

Gold Miner Polymetal to Pull Out of Russia

One of the world’s leading gold and silver miners is splitting itself apart as a result of U.S. sanctions against Russian...

The World’s Deepest Gold Mine Lives On

South Africa-based Harmony Gold Mining Company plans to extend the life of the world’s deepest gold mine by investing $410 million...

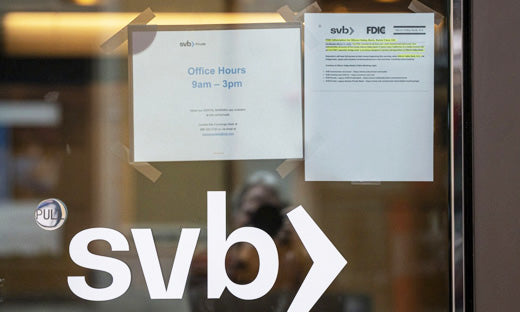

Dozens of Banks in Financial Trouble

More than 280 U.S. banks are suffering from excessive commercial real estate exposure and billions of dollars of unrealized losses...

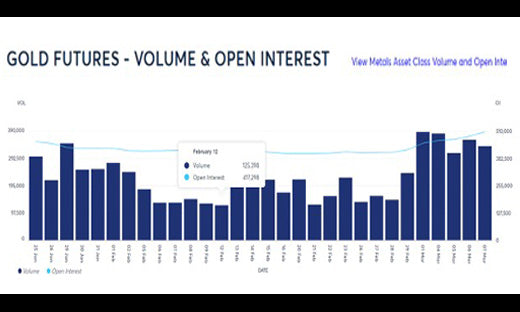

With gold reaching new all-time high levels, a growing number of investors, and precious metals analysts, are jumping on gold’s...

French Mint Forced to destroy 27 Million Coins

Sacrebleu! In a grande gaffe of minting, the Monnaie de Paris, the French Mint, has been forced to melt down 27 million ...

Without much fanfare, gold has quietly climbed to a new all-time high, reaching a new closing record of $2,184 an ounce...

Electric Vehicles Boost Silver Demand

As you see an increasing number of electric-powered vehicles on the road, be aware that those cars and trucks represent...

As property prices collapse and stocks traded on the Shanghai Stock Exchange continue sinking, the Chinese are continuing their rush into gold.